Regulators no longer accept the excuse, “the vendor made us do it.” If a cloud host crashes or a payments partner is breached, your fintech still owns the outcome: fines, escalations, angry customers, and churn.

A 2024 industry survey found that 61 percent of companies suffered a third-party breach last year, yet 60 percent still track vendor data in spreadsheets—figures reported in a 2024 Security Survey. That gap is an open invitation to attackers and a bright warning light for examiners.

Fortunately, a new generation of vendor-risk management (VRM) platforms does the grunt work for you. These tools pull security evidence in real time, map it to PCI DSS and SOC 2 controls, and surface issues before they become headlines. For lean fintech teams, the right platform can save hundreds of hours and make audit week feel like any other Tuesday.

In this guide, we review six VRM solutions vetted for continuous monitoring, fintech-specific compliance coverage, and proven customer results, all in language that stays crisp and actionable.

Ready to replace that risk spreadsheet with software built for the job? Read on.

How we picked the six platforms

You deserve a shortlist you can trust, so we started with a field of more than 40 VRM tools across banking, SaaS, and healthcare. Then we narrowed it down to what actually matters for fintech.

First, we screened for regulatory alignment. Each platform had to map controls to PCI DSS, SOC 2, FFIEC, DORA, and GDPR. No match, no place on the list.

Second, we required continuous monitoring. Annual questionnaires are not enough when vendors ship changes daily, so we prioritized tools built to surface new risk signals as they emerge.

Third, we looked for proof of impact. Public case studies, verified user reviews, and independent analyst notes counted. Marketing claims alone did not.

After those gates, we pressure-tested the practical fit using fintech-focused tie-breakers: how much evidence collection is automated, whether the platform supports AI-assisted review, how well it reuses vendor evidence through exchanges or trust centers, how cleanly it integrates into systems like Jira, Slack, and ServiceNow, and how quickly a team can get to real time-to-value without adding process bloat. Vanta’s Vendor Risk Management (VRM) implementation guide describes a best-practice workflow that uses an inherent risk rubric, scheduled security review cadences, auto-requested evidence 30 days before a review is due, and AI answer extraction from vendor documents to keep teams focused on real findings. We looked for platforms that delivered similar mechanics out of the box so fintech risk teams can spend more time on decisions and less time wiring together spreadsheets, email reminders, and manual document reviews.

The result is six platforms that pair compliance coverage with live risk signals and a clear track record of results.

1. Vanta: unified compliance meets live vendor oversight

Vanta is best known for helping teams get to SOC 2 quickly. That same automation foundation now extends into their TPRM automation software, automating questionnaires, reusing shared evidence, and continuously monitoring suppliers—an approach Vanta materials say can cut review effort by more than 50 percent for lean fintech teams.

Vanta is ideal for:

- Growing fintechs that need one system for internal compliance and third-party oversight

- Teams managing a large SaaS and API vendor footprint with limited risk headcount

- Organizations balancing PCI DSS and SOC 2 requirements with privacy and operational resilience expectations

At the core, Vanta gives you a vendor inventory, inherent and residual risk scoring, configurable questionnaires, and a vendor portal for evidence collection. It also supports shadow IT discovery and ties remediation work into the tools engineering teams already use, so vendor risk does not live in a separate spreadsheet or a separate platform.

Where Vanta stands out for fintech buyers is continuous monitoring. In addition to assessment workflows, Vanta VRM with Monitoring adds first-party external signals such as breaches, leaked credentials, misconfigurations, and vulnerability-related findings, with alerting that can be tuned by vendor criticality. Internal materials describe coverage across roughly 2,000 large vendors and 12+ cyber finding types as of Oct 17, 2025. If your program already uses third-party ratings providers such as SecurityScorecard or BitSight, Vanta can ingest those signals to add context.

On the compliance side, Vanta maps controls across 35–40+ frameworks (internal materials show 35+ built-in frameworks and 40+ as of Jan 2026), including cross-mapping that helps risk teams translate vendor evidence into auditor-friendly language for standards like SOC 2, PCI DSS, and GDPR. For U.S. financial-services teams, Vanta customers also align reviews to the 2023 interagency third-party guidance. For EU programs, teams use scheduled reviews, inherent and residual risk, and monitoring to support DORA-oriented oversight.

Vanta also leans hard into automation and AI. Vanta AI can scan vendor SOC reports, ISO certificates, DPAs, and policies to help auto-answer your templates and summarize gaps with citations, then track remediation through linked tasks. For day-to-day execution, Vanta’s 375+ integrations and workflow hooks help pull VRM into intake and delivery. Procurement and ticketing workflows can integrate with systems like ServiceNow, Freshservice, Azure DevOps, and Asana, so reviews start early, not after a contract is signed.

Evidence reuse matters when you are onboarding the same vendors as everyone else. Vanta Exchange centralizes evidence requests and reuse, including one-click pulls of public documentation from Vanta Trust Centers and workflows to request access to private documents. Indexing of third-party trust centers, including non-Vanta, is rolling out to reduce back-and-forth.

For audit and reporting, Vanta provides executive views and program reporting that roll up vendor status, findings, and residual risk. Auditors can also be given access through an in-product portal, reducing exports and one-off evidence packs.

Proof point: BetaNews reports teams cut vendor review time by up to 90 percent using Vanta’s third-party risk tooling. As with any “up to” number, results vary by vendor mix and workflow maturity.

Tradeoffs to consider: If your program requires deep sanctions, ethics, reputation screening, or bank-grade vendor financial analysis at global scale, teams sometimes complement Vanta with specialized data feeds. It is also worth validating current monitoring coverage against your specific vendor set during scoping.

Pricing: VRM is available standalone or as an add-on to broader Vanta packages. Details live on Vanta’s pricing page.

2. OneTrust: enterprise control for complex fintech programs

OneTrust is built for fintechs that have outgrown point solutions. If your third-party program spans thousands of vendors and multiple regions, OneTrust brings privacy, security, and third-party risk into a single operating model.

OneTrust is ideal for:

- Global fintechs and large payments companies with 1,000+ vendors and mature risk operations

- Organizations that need privacy and third-party risk to run together, not as separate workflows

- Teams that need executive-ready reporting across business units, geographies, and critical vendor tiers

At a core level, OneTrust supports the full third-party risk lifecycle: vendor inventory, inherent risk triage, assessments, findings, and remediation tracking. The value is less about “sending questionnaires faster” and more about running one consistent playbook across legal, compliance, and security.

For regulatory fit, the platform is designed to support broad privacy and governance needs, alongside third-party risk mapping to major standards and guidance. In practice, that breadth is what makes it attractive to multi-jurisdiction fintechs balancing privacy obligations with banking-style oversight expectations.

OneTrust’s Exchange model is a major accelerator for due diligence. Its Vendorpedia and Third-Party Risk Exchange concept centers on reusable vendor profiles, so your team can start with existing evidence and focus on exceptions. OneTrust’s own launch announcement positioned Vendorpedia at 6,000+ vendor profiles as of March 4, 2019. Current coverage changes over time, so it is worth validating counts for your vendor set during evaluation.

On continuous monitoring, OneTrust programs often bring in cyber posture through integrations and partner feeds, rather than treating native external scanning as the headline capability. As of January 2026, teams commonly pair OneTrust with a ratings provider (for example, SecurityScorecard) or other partner data to maintain ongoing cyber signal between formal assessments. The benefit is flexibility. The tradeoff is that monitoring depth depends on the third-party subscriptions you choose to procure and maintain.

Operationally, OneTrust fits best when it can sit in the middle of your enterprise stack. It integrates with tools like ServiceNow, Jira, and SIEM platforms, so remediation can flow into existing IT and security workflows instead of becoming yet another queue to manage. For reporting, OneTrust emphasizes embedded PowerBI dashboards, which helps larger organizations build regulator-ready and executive-ready views without hand-built spreadsheets.

OneTrust is also investing in AI assistance. It has previewed a “Risk Agent” designed to read and summarize Exchange materials. Availability and scope are evolving, so confirm what is generally available versus preview during scoping.

Strengths for fintech: OneTrust is strongest when you need breadth, governance, and reporting across privacy and third-party risk, especially in global, regulator-facing environments.

Limitations and tradeoffs: Implementation can take months and ongoing administration tends to be heavier than lightweight tools. Continuous monitoring is often integration-led, which can increase tool and vendor-management overhead compared to platforms that bundle first-party monitoring signals.

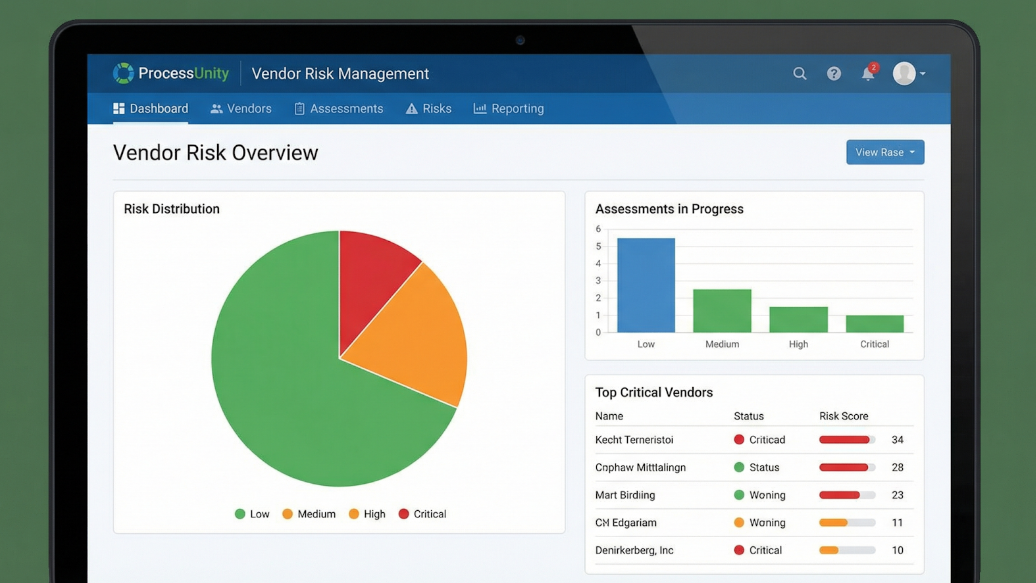

3. ProcessUnity: bank-grade workflows without the bloat

ProcessUnity is a third-party risk platform built with financial institutions in mind. It focuses on the parts of vendor risk that show up in real exams: consistent inherent and residual risk scoring, clear accountability, and documentation that holds up under scrutiny.

ProcessUnity is ideal for:

- Fintechs that need examiner-friendly workflows and reporting, not just questionnaire automation

- Programs with high-risk vendors where approvals, SLAs, and follow-ups must be tightly controlled

- Teams that want to combine internal governance with external cyber signals from ratings providers

ProcessUnity’s strength is workflow depth. When you classify a new payment processor as high risk, you can route a tailored assessment, assign reviewers, set remediation deadlines, and track completion across every step of the lifecycle. That structure is what keeps reviews from stalling when product teams are moving fast.

The platform also supports evidence reuse through an exchange model. ProcessUnity’s Global Risk Exchange heritage, tied to CyberGRX, is designed to reduce repetitive due diligence by letting teams pull shared assessments and risk profiles where available, then focus on exceptions.

For ongoing oversight, ProcessUnity programs commonly pair structured assessments with continuous signals. Your team can enrich vendor records with cyber ratings data from providers such as BitSight, giving you a steady stream of telemetry to complement document-based evidence. This is especially useful when you need to monitor large portfolios without re-running full assessments every time a vendor changes its stack.

On the regulatory side, ProcessUnity is positioned around financial-services expectations, including FFIEC-style oversight, and it also publishes DORA enablement content for EU resilience programs. In practice, that means the tool is a fit when your stakeholders want risk scoring and reporting to map cleanly to what regulators ask to see.

Implementation and time-to-value depend on how much you configure upfront. Most fintechs go live in under four weeks with guided onboarding, and that speed is typically helped by out-of-the-box templates and structured workflows. As with any workflow-heavy platform, the tradeoff is that deeper governance often requires more setup and ongoing administration than lightweight tools.

Bottom line: If your priority is a rigorous, exam-ready third-party risk program with strong workflow controls, exchange leverage, and room to integrate continuous cyber ratings, ProcessUnity is built for that job.

4. Miratech Prevalent: shared intelligence with continuous scanning

Miratech Prevalent is built for one simple reality: your team is not the only one assessing AWS, Stripe, Plaid, or the next fast-moving fintech vendor. Its model centers on evidence reuse through an exchange, paired with continuous monitoring that helps you react quickly when a vendor’s risk posture changes.

Prevalent is ideal for:

- Risk teams onboarding lots of common vendors and tired of starting every review from scratch

- Programs that want exchange-based due diligence plus continuous external monitoring in one place

- Lean fintechs that need clear remediation workflows and executive reporting without building everything manually

Prevalent’s Exchange approach is designed to cut down on vendor fatigue. The platform’s Third-Party Risk Exchange hosts more than 3,000 pre-completed assessments, and the Exchange Network is positioned around reusable risk profiles on thousands of vendors. In practice, this helps you begin with an existing packet and spend your time on gaps and exceptions, not boilerplate.

Where Prevalent goes beyond “paperwork speed” is ongoing monitoring. Its Vendor Threat Monitor runs continuously, scanning external sources for signals tied to your vendors, including breach chatter, leaked credentials, and newly disclosed vulnerabilities. Expert materials also describe coverage that extends beyond purely technical indicators into broader business and financial monitoring signals. That blend matters for fintechs, because vendor risk is not only about CVEs. It is also about whether a provider can keep operating.

The workflow is straightforward: each vendor record rolls up inherent risk, assessment results, monitoring signals, and open tasks, so your team can see what changed and what needs action in a single view. When a zero-day hits, the goal is to quickly answer two questions: which vendors are exposed, and what does our contract require us to do next?

Prevalent also supports documenting fourth-party context through its assessment and monitoring data, which helps when auditors ask how you account for sub-processors and downstream dependencies.

Tradeoffs to consider: Prevalent is not a lightweight “plug it in and forget it” tool. Implementations are often longer than starter platforms, especially if you want to fully operationalize both the exchange workflow and continuous monitoring. Also, like any external-signal approach, monitoring works best when you can corroborate issues with first-party evidence and drive clear remediation, otherwise teams risk chasing noise instead of closing gaps.

If your priority is reducing repetitive due diligence while keeping a constant watch for vendor incidents, Prevalent is a strong fit.

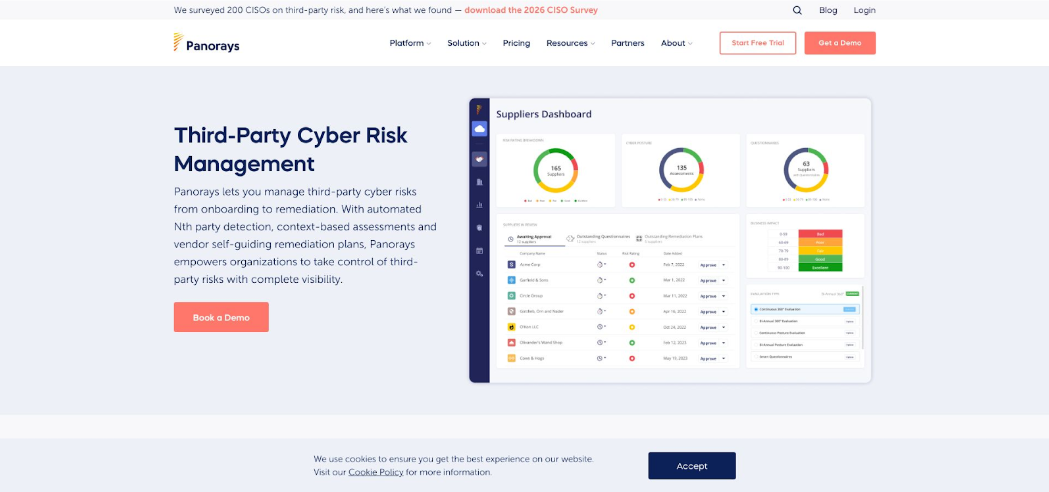

5. Panorays: external attack surface meets internal evidence

Panorays is built for teams that want a fast, defensible view of vendor cyber posture without relying on questionnaires alone. Its model combines two inputs: outside-in visibility into a vendor’s public footprint, plus inside-out evidence collection through questionnaires aligned to your requirements.

Panorays is ideal for:

- Fintechs with large partner ecosystems that need rapid prioritization across hundreds of vendors

- Teams that want external posture signals and internal evidence in one vendor record

- Programs that need a clean way to focus effort on the riskiest suppliers, not the loudest alerts

Panorays starts with external scanning of a vendor’s public-facing surface, looking for indicators such as open ports, exposed databases, and leaked credentials. Those signals become a cyber score you can use to triage your portfolio. It then pairs that outside view with questionnaires you can align to fintech staples such as PCI and PSD2, so your team is not making decisions on scans alone.

The real value shows up in correlation. When a scan flags a potential exposure and the vendor’s responses show weak controls in the same area, the risk rating can jump. That helps you focus on vendors with real gaps, not background noise.

For ongoing oversight, Panorays emphasizes continuous visibility. The platform highlights hourly rescans, which is useful when vendor posture can change faster than your review cycles. Alerts and notifications can flow into tools like Slack, keeping the team closer to the signal.

Panorays is also positioned for fourth-party awareness. A ClearBank case study cites improved visibility and prioritization at scale, and references coverage up to fourth and even n-th parties. The practical takeaway is that the platform is designed to help you understand supplier dependencies, but you should confirm how deep that mapping goes for your specific vendor set during evaluation.

Tradeoffs to consider: Panorays is not an exchange-driven tool, and external posture signals still need corroboration with first-party evidence to avoid false positives. Many fintechs also pair it with a separate GRC or internal controls platform if they want a single system for both internal compliance automation and third-party oversight.

If you need fast vendor prioritization backed by a blend of external scanning and internal evidence, Panorays is a strong fit.

6. Venminder: vendor risk as a service for fintech newcomers

Venminder is a strong fit when software alone will not close the gap. If your team is lean and exams still expect bank-grade due diligence, Venminder pairs a VRM platform with an analyst bench that can do the heavy review work for you.

Venminder is ideal for:

- Seed-to-mid-stage fintechs building a formal VRM program without hiring a full TPRM team

- Risk and compliance leaders who want examiner-ready write-ups, not just a document repository

- Teams that need help reviewing long SOC reports and translating findings into clear action items

On the platform side, Venminder covers the vendor lifecycle: onboarding, assessments, monitoring, and offboarding, with dashboards that track status, renewals, and residual risk. Where it differentiates is the service layer. When a critical vendor sends a 100-page SOC 2, Venminder’s analysts can review it, rate the findings, and deliver a concise report back into your program workflow. That turns “we have the documents” into “we have a defensible conclusion.”

Venminder also offers continuous monitoring through its Venmonitor modules, positioned to cover cybersecurity, business, and financial domains. For fintech teams, that matters because a vendor issue is not always a breach. It can be an operational change that impacts availability, resilience, or contractual obligations. Exact monitoring sources vary, so it is worth confirming what signals you get out of the box.

For regulatory alignment, Venminder is oriented toward financial-services expectations, with templates and deliverables designed around FFIEC and OCC-style oversight. Expert notes also reference support for aligning assessments to standards and frameworks such as ISO, NIST, HIPAA, and GDPR when relevant to your program.

Evidence reuse is available through an Exchange model, where you can order or access completed assessments instead of restarting due diligence from scratch. Combined with managed reviews, that can meaningfully reduce vendor chasing.

Pricing and operating model: Venminder typically combines a software subscription with optional, à la carte managed assessments. That gives you flexibility to outsource only the high-effort reviews while keeping simpler vendors in-house.

Tradeoffs to consider: A service-centric approach can add recurring assessment costs as your vendor count grows. Teams also often pair Venminder with a separate internal GRC or compliance automation platform if they want the same tool to run internal controls. Finally, if you have strict data residency needs, confirm hosting and document-handling expectations during procurement.

Proof points: Venminder states that roughly 900 organizations trust its platform and that its analysts complete around 30,000 vendor risk assessments annually. Those figures can change year to year, so validate the latest numbers during evaluation.

How to choose the right VRM tool

Start with the outcome you cannot compromise on.

If exam readiness is the priority, optimize for governance. Tools like ProcessUnity and OneTrust are built to mirror regulator expectations, with deeper workflows and reporting that map cleanly to how examiners ask questions.

If speed is the constraint, optimize for automation. Vanta is designed to shorten the time between “new vendor request” and “risk decision,” by reducing manual evidence gathering and review work.

From there, pressure-test your shortlist with a few hard questions:

- How many vendors do you manage, and how many people run the program? A two-person team supporting 400 suppliers needs automated evidence collection and pre-scoring to stay focused on exceptions, not inbox chasing.

- What monitoring signal do you actually need? Some programs want external breach and exposure intelligence. Others need controls-based evidence that stays current between reviews. Pick the model that matches how you expect to detect issues, then confirm how alerts flow into remediation.

- Where will the work live? If engineering lives in Slack and Jira, prioritize tools that push risk signals and remediation tasks into those systems. If your organization runs on ServiceNow and SIEM workflows, choose a platform that fits that center of gravity.

- Do you need evidence reuse at scale? Exchanges and trust centers can eliminate repetitive “send me your SOC 2” loops. If vendor fatigue is already a problem, treat reuse as a requirement, not a nice-to-have.

- What is your real cost of ownership? License fees matter, but so does time-to-value. A cheaper tool that takes six months to deploy can cost more in risk exposure and lost time than a pricier platform you can operationalize next quarter.

- How much expert help do you need? If you are light on in-house reviewers, Venminder’s analyst reports or Prevalent’s managed assessments can act as force multipliers. If you have a mature TPRM team, self-service platforms often give more control with lower ongoing service costs.

Make these decisions upfront, then run demos against your actual workflow: one high-risk vendor onboarding, one incident-driven reassessment, and one audit evidence request. The right fit becomes obvious when the tool handles real work, not a polished slide deck.

Common vendor-risk mistakes fintechs still make

Treating assessments as annual chores. Risk does not follow the calendar. A vendor can introduce a critical vulnerability the day after you close out a questionnaire. Without continuous monitoring, you learn about the issue when customers do.

Ignoring the fourth party. Your payment processor’s cloud host becomes your risk too. For every critical vendor, document their sub-vendors and dependencies. Otherwise you miss the single point of failure hiding two layers deep.

Confusing security with compliance. A partner’s stack can be well secured and still put you out of bounds on PSD2 or GLBA. Map findings to the exact requirement you must satisfy. That is how vague concerns turn into clear remediation tasks.

Keeping the board in the dark. Executives do not need packet captures. They need a heat map and a trend line. Regular, digestible reporting turns vendor risk from technical noise into a metric the company can manage.

FAQs: quick answers for busy risk teams

Do we really need a VRM tool, or can spreadsheets work for now? Spreadsheets track rows, not risk. Regulators expect evidence of continuous oversight, and customers assume you catch vendor issues before they go public. A dedicated VRM platform automates reminders, stores immutable audit trails, and surfaces live alerts. Those are capabilities Excel cannot deliver.

How do these tools connect with our existing stack? Most vendors provide connectors for cloud accounts, ticketing systems, and chat apps, so work happens where your team already operates. Security findings can surface in Slack, remediation tasks can land in Jira, and executive reporting can plug into your BI workflows. Integration is not a luxury, it determines whether risk signals become action or die in another inbox.

What about major cloud providers like AWS and GCP, aren’t they already compliant? Yes and no. They maintain certifications, but you remain responsible for how you configure and monitor their services. Leading VRM platforms help you centralize the latest SOC 2 and ISO reports from these providers, then layer on monitoring signals to flag newly emerging issues. You get both the paperwork and the day-to-day signal in one place.

Conclusion

Regulators are turning vendor risk from a best practice into a hard requirement. The 2023 U.S. interagency guidance makes banks—and by extension their fintech partners—fully accountable for third-party failures. Across the Atlantic, the EU’s Digital Operational Resilience Act (DORA) applies from January 17, 2025, and demands a central register of all ICT suppliers, complete with exit plans and testing evidence.

The direction is clear: oversight must be continuous, documented, and visible at the board level. VRM platforms that can export a DORA-ready vendor register or map controls to the new U.S. guidance move from “nice to have” to “non-negotiable.”

Technology is shifting just as fast. Only five percent of programs use AI for vendor risk today, yet about 66 percent are piloting it. Expect questionnaire autofill, anomaly detection, and generative risk summaries to become standard by 2027. Among the tools in this guide, Vanta is the furthest along.

Concentration risk is also rising. Regulators are increasingly concerned about the fintech sector’s reliance on a handful of cloud and payments providers. That makes fourth-party visibility harder to ignore. Mapping vendor dependencies—and showing how you respond when a sub-processor becomes the weak link—is becoming standard exam evidence. Fourth-party mapping features, now available in OneTrust and Prevalent, will likely matter more in future exams.

The rule book is getting thicker, but the software is keeping pace. Choose a platform that tracks regulation updates for you, and tomorrow’s audit feels far less daunting.

Leave a Reply